Financial Agreements are a legal tool that you can use to clarify how assets and liabilities are owned, in what proportions and what should happen if the relationship breaks down.

Financial Agreement or Binding Financial Agreements (BFAs) are an umbrella term that covers a range of agreements suitable for the division of finances at every relationship stage. That is, you can make one if you are cohabitating or living together, getting married eg. prenup is a familiar term, or separating.

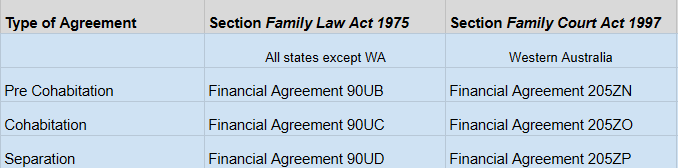

For de facto matters financial agreements are legislated by the Family Law Act 1975 (all states except Western Australia) and the Family Court Act 1997 (for Western Australia).

Different sections of these Acts determine what should be in each type of agreement. So, if we consider the Family Law Act 1975, Section 90UC describes how a financial agreement should be set out for a couple living together in a de facto relationship. If you were divorced you would use a Financial Agreement made under section 90D of the Family Law Act.

For ease of reference, as were dealing with de facto couples who are living together we will reference the necessary financial agreement as either a Cohabitation Agreement or a 90UC Financial agreement. If you were thinking of moving in together then you would make a pre cohabitation agreement or financial agreement 90UB.

If you are in Western Australia a cohabitation agreement agreement is referred to as a Financial Agreement 205ZO, and the pre cohabitation is a Financial Agreement 205ZN.

This table sets out the terms for both Acts.

Financial Cohabitation Agreements can address many issues, including how a couple will :-

Couples often use a Financial Agreement to protect assets accumulated before the relationship for existing children. Financial Agreements empower couples to take control of their finances and make their own decisions about management.

The Family Law Act makes Financial Agreements available to all couples. This promotes private agreements and certainty, reducing potential disputes or misunderstandings in the future.

Financial agreements offer several benefits for de facto couples, including:

This can alleviate misunderstandings and disputes that might later arise, and give couples a common understanding and foundation upon which to base their financial future.

Considering that money problems are the number one reason for relationship woes and breakups, it makes sense that a couple should learn to discuss finances – how they see themselves advancing financially and their goals and aspirations for the future.

Couples in a de facto relationship can enter into a financial agreement at any stage of their relationship:

A financial agreement made after separation is known as a Separation Financial Agreement. All de facto couples can create Separation Financial Agreements, regardless of the relationship’s duration. You do not need to have been in a relationship for at least 2 years to make a Separation Financial Agreement after a breakup.

Initiating a discussion about assets and finances becomes easier if your partner also has assets. In this case, your partner will likely want to reach a mutual agreement on managing assets accumulated before and during the relationship.

For example, you and your partner can decide to quarantine assets accumulated separately before the relationship began. This way, if the relationship ends, each person retains the assets they brought into the relationship, and any assets accumulated during the relationship can be divided based on each person’s contribution.

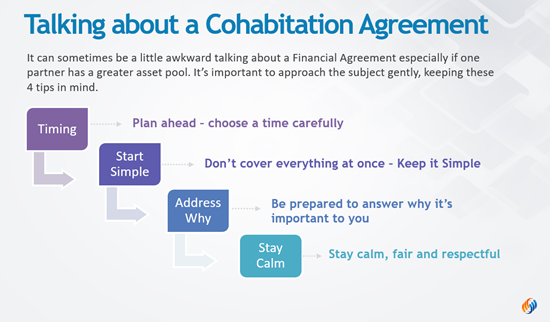

If your partner has no assets but you do, the discussion may be more delicate. Nonetheless, it’s important to discuss your intentions openly and honestly. Approach the subject gently and avoid a defensive or combative tone. You are partners building a solid foundation for your future together.

Getting the timing right

When considering a Cohabitation or Pre-Nuptial Agreement (“Financial Agreement”), take your time and plan ahead. Avoid surprising your partner with a pre-drafted Financial Agreement and requesting a signature without prior discussion, especially on the day you’re moving in together or getting married. This approach is insensitive and likely to be invalid due to undue pressure and duress, as shown in an Australian case where a woman was told to sign a prenup or the wedding would be off.

The process requires time from initial discussions to signing, so start sooner rather than later. Begin discussions well in advance of your planned marriage or move-in date. Both parties should contribute to the Agreement and be fully satisfied with its terms. A Financial Agreement can also be established after marriage or cohabitation has begun.

Pick your moment

Have an answer to the question “why do we need a contract?”

Prepare an answer for when your partner questions the necessity of a financial agreement. Examples include:

Stay calm, fair, and respectful – focus on the goal

Remember, you’re in this together. Talking about finances can be stressful, but staying calm, fair, and respectful will help you navigate the process successfully.

Same sex de facto couples have been recognised under Australia’s family law framework since 2008. Just like heterosexual couples, same sec couples can access substantial rights and avenues of legal recourse that were once only enjoyed by married couples.

The family law allows same sex couples legal avenues to address family related matters including:-

We offer a range of financial agreement templates specifically tailored to gay and lesbian couples.

De facto couples only have the option of going to court if they separate and need to arrange property settlement. Going to court is generally considered a last resort. We cover court and de facto couples in our section on separation.

If a same-sex de facto relationship is registered in the appropriate state or territory, the couple automatically gains the right to make a court application. This bypasses the usual 2-year relationship requirement. Registration effectively grants de facto couples many of the same rights as married couples.

In several Australian states, de facto couples can register their relationship with the Department of Births, Deaths, and Marriages. Once approved, they receive a relationship certificate similar to a marriage certificate. Registration is open to all couples, whether same-sex or heterosexual.

States that allow de facto relationship registration:

Benefits of registering your de facto relationship: Registering your relationship is easy and inexpensive, formalising your de facto status and commitment. Legal benefits include:

Other ways to prove your de facto relationship: If not registered, you may need to prove your de facto relationship. The legal system considers:

This process can be intrusive and public. Registered relationships do not require such extensive proof.

Updating your status if you separate: You can update your status by lodging the appropriate form with the Births, Deaths, and Marriages Registry of your state. A de facto relationship automatically terminates if one partner dies, you get married (changing your status to married), or one partner marries someone else. Inform BDM to update your records accordingly.

Centrelink notification of relationship: If you receive benefits based on your relationship status, notify Centrelink upon entering a de facto relationship. This differs from registering with the Department of Births, Deaths, and Marriages. Submit your Certificate of Registration of Relationship to Centrelink as proof.

Centrelink considers a person partnered if they are:

For more information on Centrelink’s requirements for de facto couples, visit their website.

Some of our customers have faced a frustrating issue when making a binding financial agreement while living together in a de facto relationship but planning to marry in the future.

The court has now clarified that couples can make financial agreements under two sections of the Family Law Act. You can create a Financial Agreement under either the de facto provisions or the marriage provisions. If a couple makes a binding financial agreement under the de facto provisions, the agreement will no longer apply once they are married. Similarly, if they create a pre-nuptial agreement anticipating marriage, but the marriage does not happen and they remain in a de facto relationship, the Agreement won’t cover the breakdown of the de facto relationship.

This confusion was addressed in the case of Piper & Mueller [2015]. A couple living in a de facto relationship, intending to marry, made their agreement under both the de facto and marriage provisions. They intended this to cover their relationship before and after marriage.

The marriage did not happen, and the Agreement’s validity was challenged. The court ruled that there is no legal barrier to making an agreement under both provisions. While the couple is in a de facto relationship, the de facto provisions apply. Once married, the marriage provisions take over.

This ruling is beneficial for customers in de facto relationships planning to marry. Instead of creating separate financial agreements for de facto and marriage, a single de facto agreement will continue to be valid after marriage.

However, it is wise to review your agreement regularly, especially if you decide to marry or have children, to ensure it still reflects both parties’ wishes. You can always end a financial agreement and create a new one if needed.

How do I start a Financial Agreement? Starting a Financial Agreement involves discussing and agreeing on how you will handle finances during your relationship and if it ends. It’s recommended to seek legal advice to ensure the agreement is valid and enforceable. See our article on how to write a cohabitation agreement.

What happens if we don’t have a Financial Agreement? Without a Financial Agreement, the division of assets and liabilities will be determined by the court, which may not align with your wishes. Having an agreement in place provides clarity and helps prevent disputes.

Can a Financial Agreement be changed? No, once it is finalised it is cast in stone as it were. If you wish to change the agreement, you need to cancel the old agreement and make a new agreement. Read more in our Article Changing Financial Agreements

What are the costs involved in making a Financial Agreement? The costs can vary depending on the complexity of the agreement. It’s a good idea to get quotes from several lawyers to understand the potential expenses. Once you have done that, you can compare that cost to using our financial agreement kits and Legal Review Service. This package allows you to create a legally binding financial agreement for a fraction of the normal cost.

Is a Financial Agreement legally binding? Yes, if it meets the requirements set out in the Family Law Act, including both parties receiving independent legal advice.

How does a Financial Agreement protect my assets? A Financial Agreement can specify how assets and liabilities will be divided, protecting what you brought into the relationship and detailing how jointly acquired assets will be managed.

Can we still make a Financial Agreement if we’re already living together? Yes, you can make a Financial Agreement at any stage of your relationship, whether you’re just moving in together, have been cohabiting for some time, or are separating.

Do we need a lawyer to make a Financial Agreement? While you can draft an agreement yourselves, it’s a legal requirement to obtain legal advice before signing the agreement.

How do we prove a de facto relationship exists? Evidence of a de facto relationship can include shared living arrangements, joint finances, and social recognition as a couple. Registering your relationship can also provide formal proof.

What happens if our relationship ends? If your relationship ends, a Financial Agreement will outline how assets and liabilities will be divided, which can help avoid lengthy and costly legal disputes.