In any case, unless you get legal advice before you sign the document, it will be worthless and inadmissible in court.

However…

One way to write a cohabitation agreement yourself without a lawyer is to use a high-quality Binding Financial Agreement template kit from RP Emery & Associates.

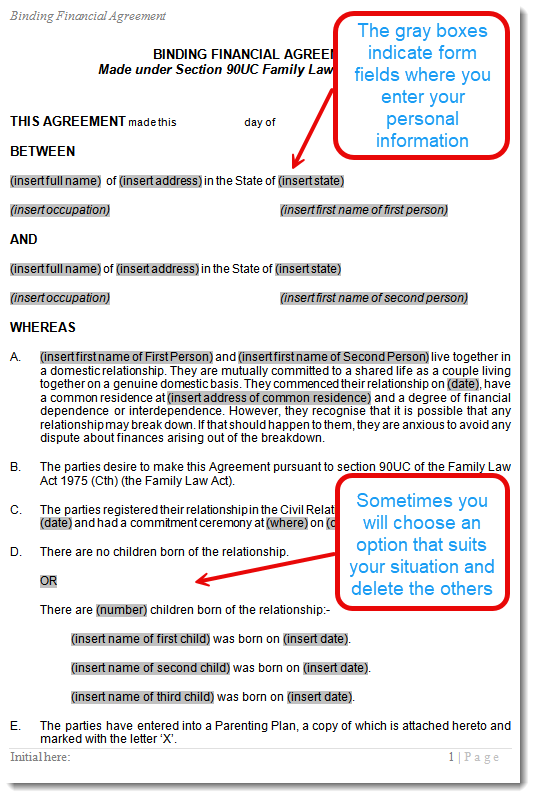

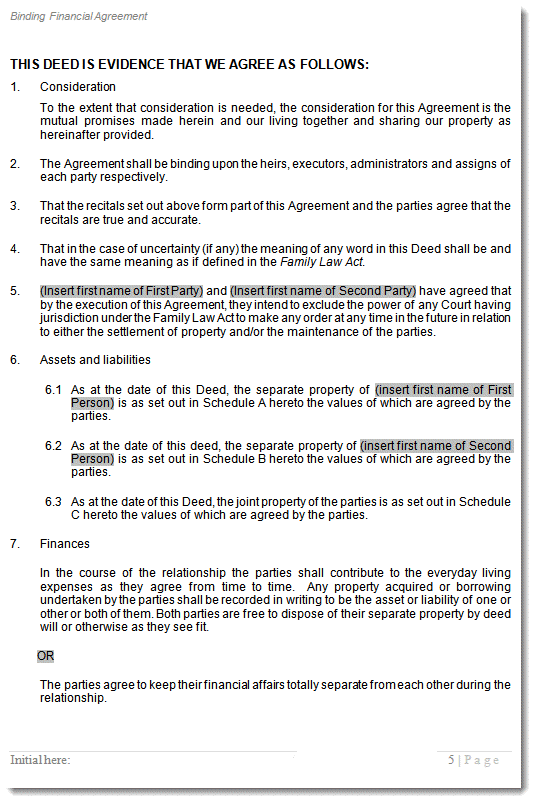

The kit contains instructions and a template agreement that covers all the standard issues any cohabitation agreement should cover. Think of it like the basic framework to create your own agreement, which you tailor to your specific needs.

Unlike documents from other countries, the RP Emery kit is drafted specifically for Australia by Australian legal professionals.

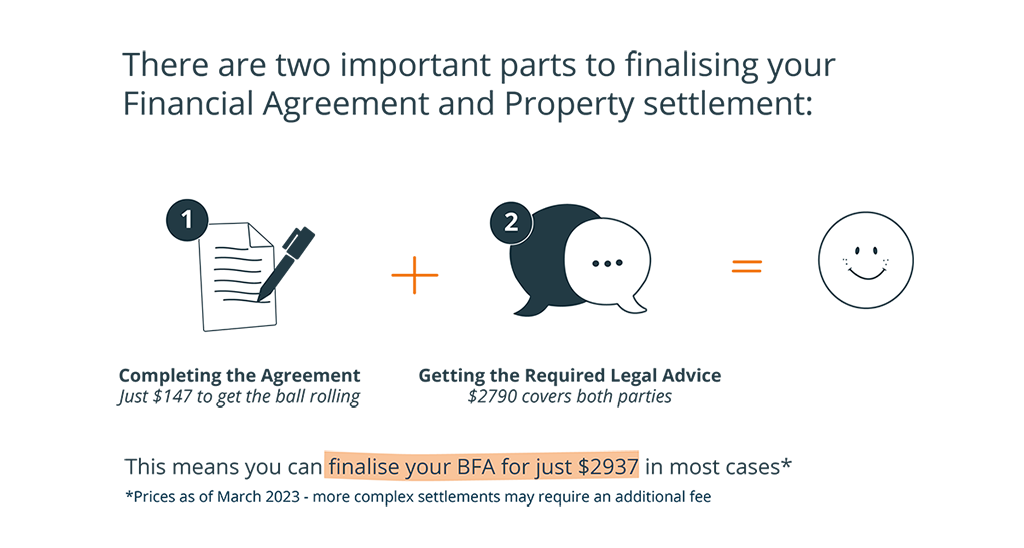

Once you have a draft agreement, you can use our Fixed Price Legal Review Service to make your agreement binding.

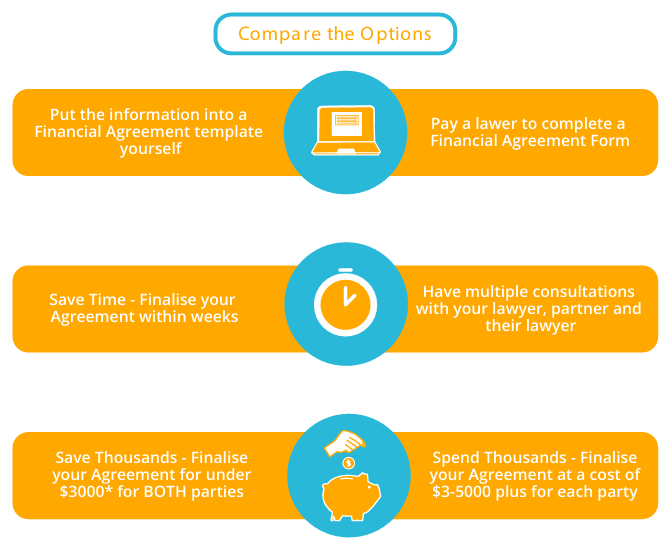

Traditionally, you would engage a lawyer to draft the agreement for you. This involves several meetings to determine what you want the agreement to achieve, and as lawyers charge by the hour, it is easy to see how the costs escalate quite rapidly.

Alternatively, you can start with a template kit and do more of the work yourself, saving you considerable time and money. But remember, you will still need legal advice before you sign to ensure your agreement is binding.

When you visit a lawyer for the first time, you can expect a meeting to flesh out your needs. From that meeting, you’ll be required to provide certain information, such as:

Once that information has been provided, a document will be prepared (generally from a template the firm has used previously), and another meeting will be scheduled to review the draft agreement. You may need to provide additional info, and there may be several emails back and forth. All the while, the meter is running at the hourly rate. The more meetings and emails, the higher the cost.

Once a document has been prepared, you will provide a copy to your partner, who must then seek his/her own legal advice. It’s a time-consuming and costly process.

All that to-ing and fro-ing can be avoided if you use a template kit.

You will still need to provide all that information, but instead of paying a lawyer to enter the data into their template, you and your partner can enter the information straight into a template yourselves.

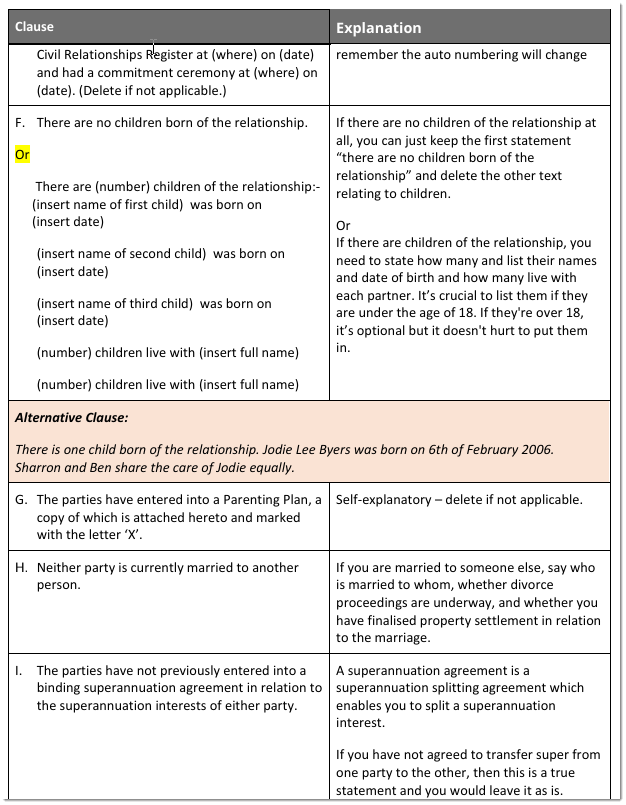

We’ve provided screenshots of the cohabitation agreement template so you can see how easy it is to complete.

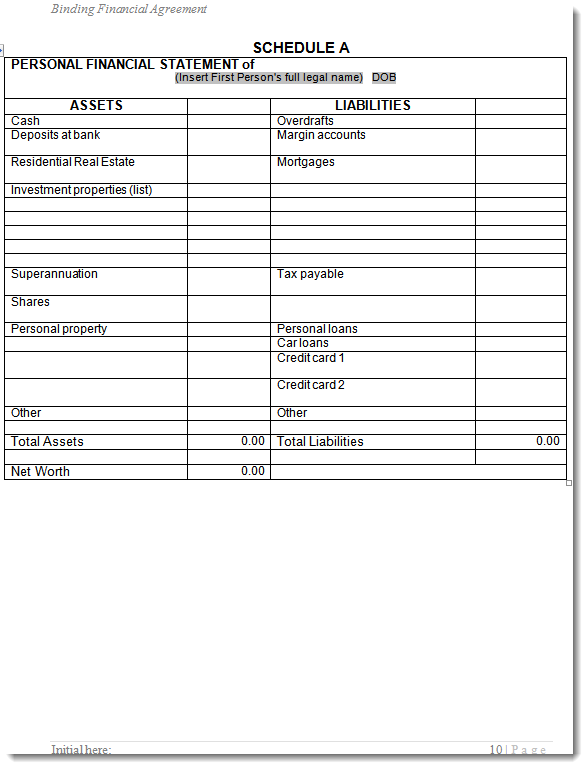

There are three assets and liabilities schedules in the agreement: one for each partner and one for joint property.

The RP Emery kit also includes a comprehensive Users Guide which essentially walks you through the process of writing your financial agreement.

It’s worth noting that most cohabitation agreements say much the same thing.

Generally speaking, the couple have property (houses/mortgages, savings, shares, cars, superannuation, etc.) they wish to manage. Usually they decide that any assets or debt accumulated before they became a de facto couple remains an individual asset or debt. Anything accumulated together forms part of the joint property pool. This is the basic premise of our template agreement.

At the end of the day, the lawyer who provides your legal advice is responsible for advising you about the effect of the agreement and any deficiencies in that document. So, whether you start with a template or not, the level of protection and the quality of your final agreement is ultimately determined by the lawyer who provides your legal advice – which is why we have chosen our lawyers very carefully.

The lawyers who provide our Fixed Price Legal Review Service are family law experts with years of experience and who have advised thousands of clients about their financial agreements. This field of family law is their bread and butter, and you can be sure they will fulfil the requirements of the legislation in relation to your individual matter.

Let’s take a look at the process:

We work with you In a nutshell – we work with you from start to finish, from the moment you download your agreement to the final signature. We know our stuff, our systems are finely tuned, and our customers love us for it!

A Word of Warning If you decide to download a document from the internet, only a document drafted to comply with Australia’s Family Law Act and reviewed by an Australian lawyer will protect you. If you can’t speak in person to the staff of the company making the offer, proceed with caution.

On the other hand, if you want to speak with us, all you have to do is pick up the phone and call 1800 608 088.

If you’ve already done your homework you will know that instructing a lawyer to draft an agreement for you from scratch could cost you literally thousands of dollars.

By the time you add up multiple visits to your lawyers office at over $350.00ph plus the time off work and travelling, it doesn’t take long to see where your money goes.

We understand that most people can’t afford to fork out thousands of dollars to protect themselves from financial ruin.

The good news is you don’t have to. You can get the legal protection you seek to safeguard future assets by using our Financial Agreement Kit and Legal Review Service.

Get Started today – Download the Financial Agreement Kit For De Facto Couples