You can choose to deal with all of your financial interest now or you may choose to deal with a single asset like a family farm, a business or an inheritance.

You can choose to deal with all of your financial interest now or you may choose to deal with a single asset like a family farm, a business or an inheritance.

Couples often use a Financial Agreement to protect assets accumulated before the relationship for existing children.

Financial Cohabitation Agreements allows you to decide how you will :-

Financial agreements can comfort and reassure people living in or entering into de facto relationships. They are recognised and enforceable under Part VIIIAB of the Family Law Act and can save you time, money and a lot of heartaches.

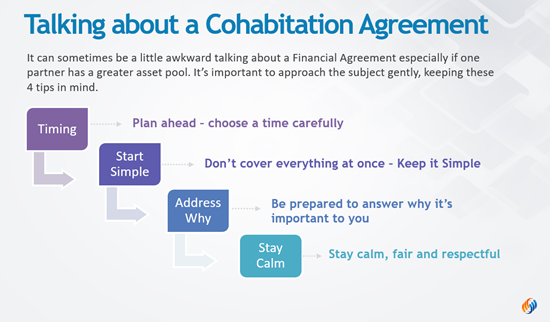

Talking about legal and financial issues can be confronting. But communicating openly and honestly with each other about difficult topics will give you a solid foundation for getting through tough times.

That being said, it’s important to approach the conversation with some sensitivity. We recommend that you:

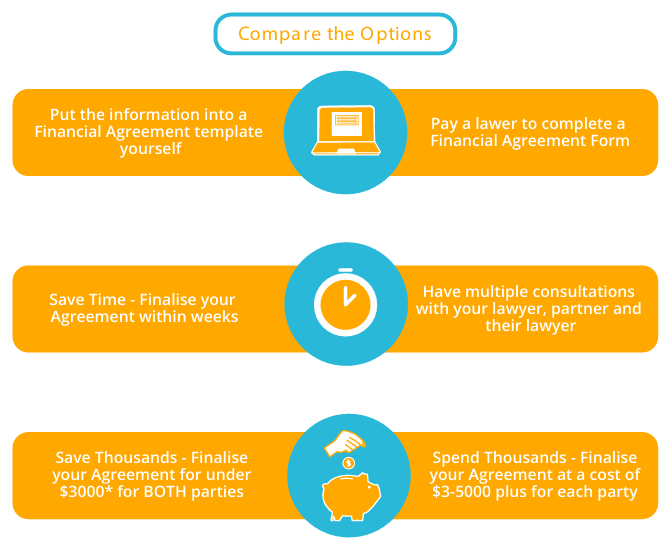

Traditionally, you would engage a lawyer to draft the agreement for you. This involves several meetings to determine what you want the agreement to achieve, and as lawyers charge by the hour, it is easy to see how the costs escalate quite rapidly.

Alternatively, you can start with a financial agreement (cohabitation) template kit and do more of the work yourself, saving you considerable time and money.

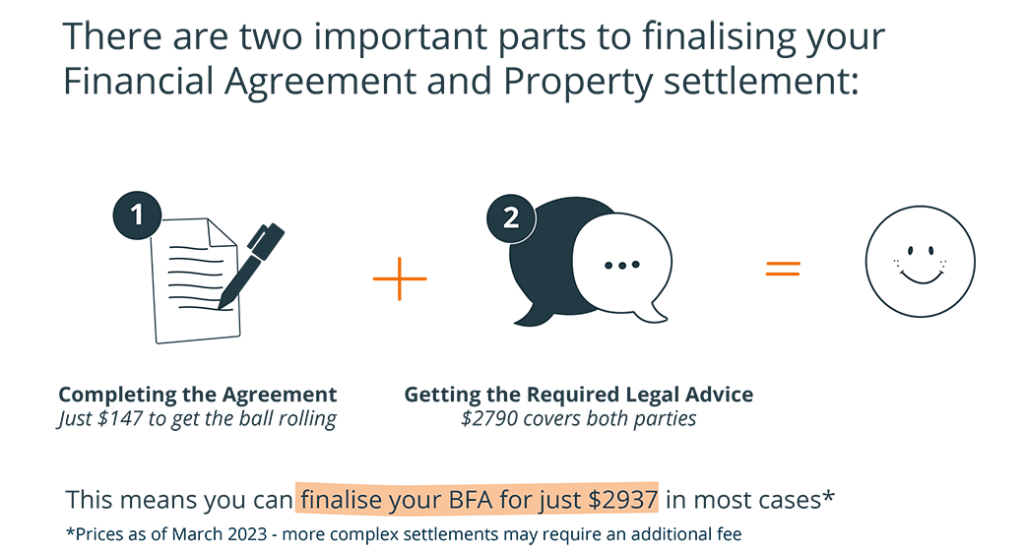

But remember, you will still need legal advice before you sign to ensure your agreement is binding.

When you visit a lawyer for the first time, you can expect a meeting to flesh out your needs. From that meeting, you’ll be required to provide certain information, for example:

Once that information has been provided, a document will be prepared (generally from a template the firm has used previously), and another meeting will be scheduled to review the draft agreement.

You may need to provide additional info, and there may be several emails back and forth.

All the while, the meter is running at the hourly rate. The more meetings and emails, the higher the cost.

Once a document has been prepared, you will provide a copy to your partner, who must then seek his/her own legal advice.

It’s a time-consuming and costly process.

All that to-ing and fro-ing can be avoided if you use a template kit.

You will still need to provide all that information, but instead of paying a lawyer to enter the data into their template, you and your partner can enter the information straight into a template yourselves.

It’s easy to see how this can save you a bundle in legal fees!

All in all, you can complete your de facto cohabitation financial agreement and have peace of mind about your future financial security for just $ (unless you have very complicated financials)

This de facto agreement kit has been professionally drafted to comply with section 90UB of the Family law Act or section 205ZO of the Family Court Act (Western Australian) and allows you to complete a defacto financial agreement with a minimum of fuss. It includes;

The legal Advice acts a safety net, and ensures that both parties understand the effect that the agreement has on their legal rights. It is mandated by Section 90UJ of the Family Law Act, which states that each party to the agreement must receive independent legal advice before the agreement has any legal force.

To fulfil this requirement, RP Emery provide an Agreement Review and Legal Certification Service .

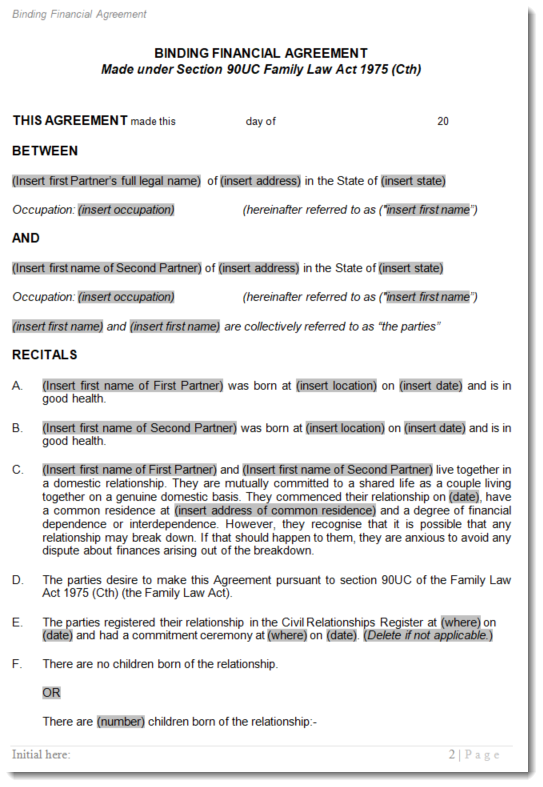

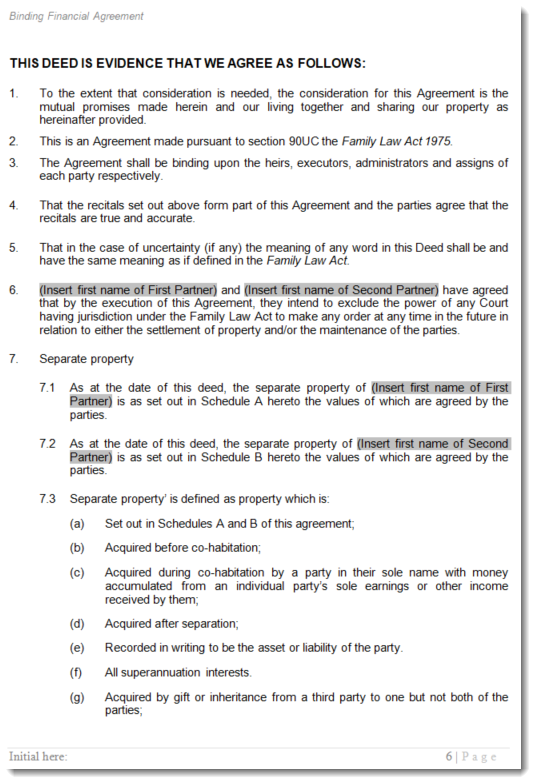

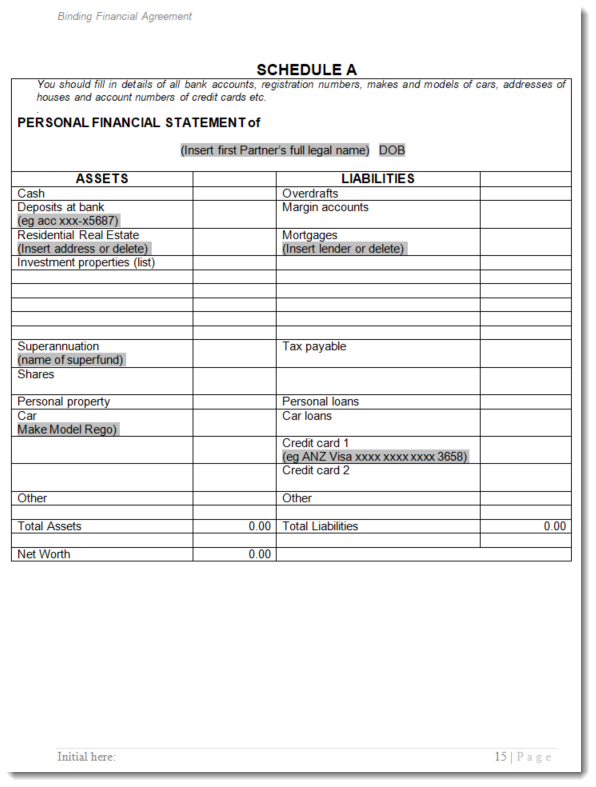

We’ve shown the agreement for all states except W.A., heterosexual couple.

The grey boxes indicate form fields where you enter your personal information.

| Agreement Type | All states EXCEPT WA | Western Australia |

|---|---|---|

| Already Living Together | Buy Financial Agreement 90UC Kit | Buy Financial Agreement WA 205ZO Kit |

| Planning to Live Together | Buy Financial Agreement 90UB Kit | Buy Financial Agreement WA 205ZN Kit |

If for any reason you are not completely satisfied with your purchase or our service, please phone our office on 1800 608 088 within seven (7) days of purchase and we will rectify the situation, issue a refund, or offer a credit towards future purchases.