Making a pre de facto agreement before you move in together gives you peace of mind that your assets are protected. It allows you to stipulate and quarantine particular assets or financial resources from claim should the relationship break down.

Greg and Yana are a professional couple, each of them recovering from a previous marriage split. Although they both feel their new relationship will be strong and withstand the test of time, they are nervous about combining all of their finances before they have been together for a longer period.

Greg and Yana can set some ground rules about their property before entering into the next phase of their life together, which will give them the peace of mind that they seek.

Greg and Yana can set some ground rules about their property before entering into the next phase of their life together, which will give them the peace of mind that they seek.

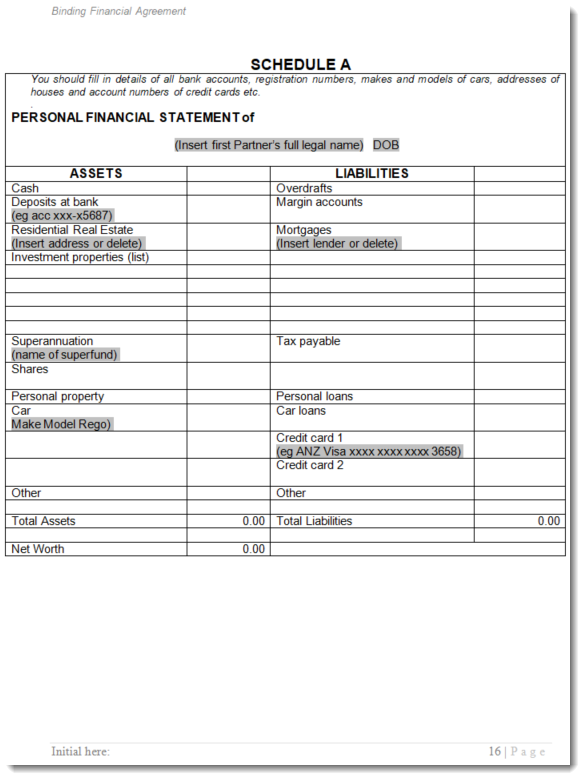

Essentially, both Greg and Yana need to disclose to each other all assets and liabilities they each own before moving in together and include this disclosure in their Financial Agreement.

They are each responsible for the debts they bring to the table and each can leave with the assets they have brought into the partnership if things don’t work out.

If they choose, they can make provision to keep all of their finances totally separate or combine some of their finances, such as living expenses. Greg and Yana can also make provision for real estate they purchase together should they choose to do so.

The agreement template is provided as a word doc format, so it is easy for you to edit. The kit also includes a comprehensive Users Guide, Sample Agreement and our personal phone support.

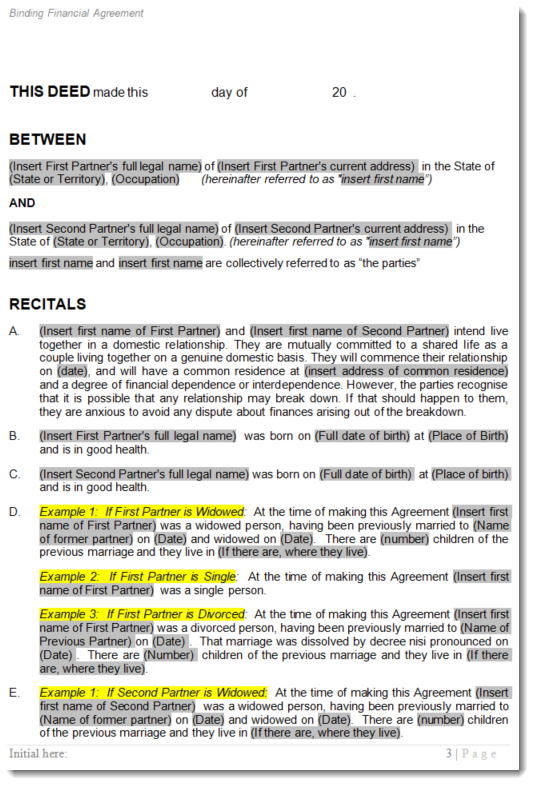

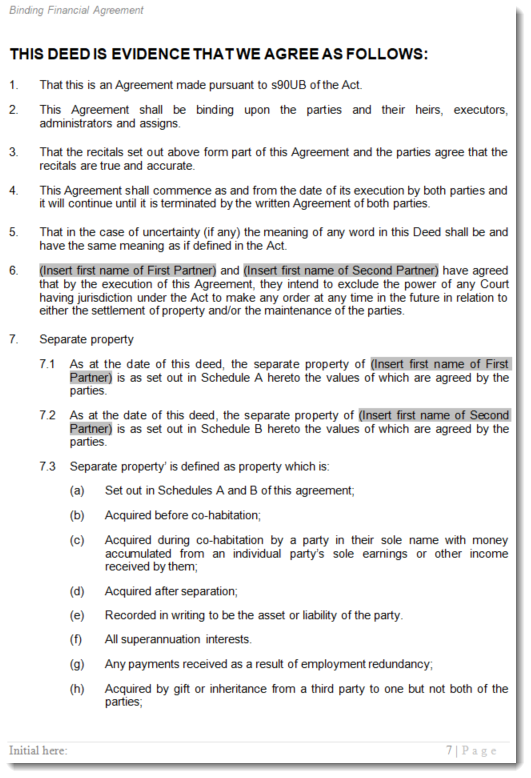

The grey fields indicate areas where you add your data. The yellow highlights indicate clauses where you would choose an option.

This pre de facto agreement kit has been professionally drafted to comply with section 90UB of the Family law Act and allows you to complete a pre defacto financial agreement with a minimum of fuss. It includes;

Buy De Facto Pre Cohabitation Financial Agreement WA 205ZN for Western Australia

Section 90UJ of the family law act requires both parties to obtain certification of independent legal advice from a legal practitioner.

Essentially both partners are required to have a conversation with an independent lawyer about their agreement to make sure that they each understand:

After the consultation, their lawyer is required to issue them with a Certificate of Legal Advice. This certificate is attached to the financial agreement and then the parties can sign the agreement and move on with their lives confident that their financial resources are protected.

This Legal Advice acts as a Safety Net and ensures the strength of your agreement .

Our Legal Review Package assists you to complete your financial agreement properly, meeting the requirements of the Act, with a minimum of fuss and expense.