Splitting superannuation as part of your financial agreement has many benefits. It means that you stay in control of the process by making your own decisions and choices as to how your super should be split.

By making a private binding Agreement, you bypass adversarial style court proceedings which can be drawn out and costly.

If a private agreement cannot be reached about whether, or how, superannuation should be split, then it may be necessary to apply to the Court for a Court Order.

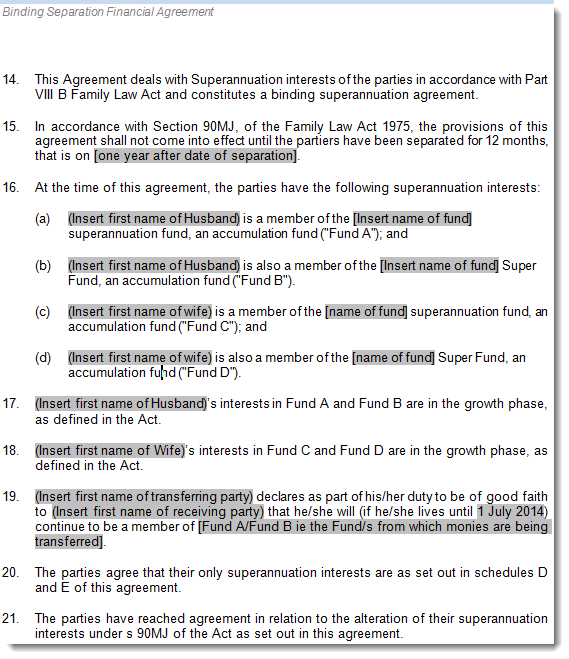

This Superannuation Agreement Template is provided to you as a Word document. It’s easy to use – just insert your data in the appropriate fields and go to print. The kit includes:-

Whatever your needs, we have an agreement template to suit your situation. If you can’t see your document on the list below please call us on 0266725904 or e-mail us and we will provide a link to the agreement you need.

It’s worthwhile noting that any amount transferred under a superannuation agreement will be treated in accordance with the normal rules that affect superannuation benefits. That is, you can’t take it as cash and go on a world trip unless you’ve already retired.

Industry or Retail Fund Buy Marriage Separation Financial Agreement inc Super Split 90C

Self Managed Super Fund (SMSF) Buy Marriage Separation Financial Agreement inc SMSF Super Split 90C

Industry or Retail Fund Buy Divorce Financial Agreement inc Super Split 90D

Self Managed Super Fund (SMSF) Buy Divorce Separation Financial Agreement inc SMSF Super Split 90D

Industry or Retail Fund Buy De Facto Separation Financial Agreement inc Super Split 90UD

Self Managed Super Fund (SMSF) Buy De Facto Separation Financial Agreement inc SMSF Super Split 90UD

Industry or Retail Fund Buy Marriage Separation Financial Agreement inc Super Split 90C

Self Managed Super Fund (SMSF) Buy Marriage Separation Financial Agreement inc SMSF Super Split 90C

Industry or Retail Fund Buy Divorce Financial Agreement inc Super Split 90D

Self Managed Super Fund (SMSF) Buy Divorce Separation Financial Agreement inc SMSF Super Split 90D

Industry or Retail Fund Buy De Facto Separation Financial Agreement inc Super Split 90UD

Self Managed Super Fund (SMSF) Buy De Facto Separation Financial Agreement inc SMSF Super Split 90UD