If you’ve already been through a messy divorce, it’s natural to want a back-up plan before getting married again.

Fortunately, Australia’s lawmakers introduced Binding Financial Agreements so you can quarantine your assets from claim should an unthinkable separation occur in the future.

A financial agreement made before marriage is more commonly known as a prenuptial agreement or ‘prenup’. So whenever people talk about a marriage prenup or a binding financial agreement, they’re talking about the same thing.

There are two important parts to making your Financial Agreement legally binding:

We’re going to show you how to complete your prenup agreement and get the legal advice for both parties for just $ – without stress, fuss or engaging combative lawyers.

The First Step is to complete the Prenup Agreement.

Buy Prenuptial Financial Agreement 90B Template Kit NowThere are many compelling reasons why one might want to put a financial agreement in place.

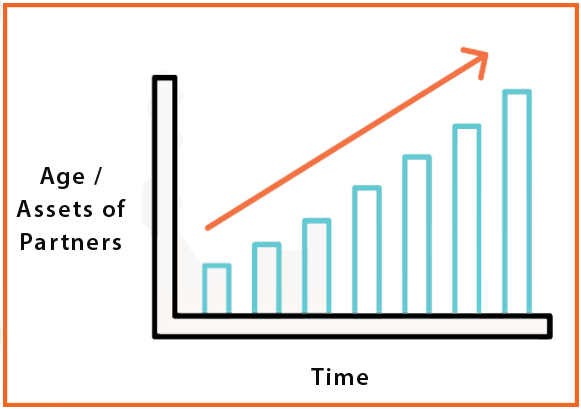

Over the last 30 years, couples have tended to live together before marriage and consequently the age of Australians entering first marriages has steadily risen.

It’s quite common for two people to have well paid employment and significant assets and debts before marriage.

So it comes as no surprise that one or both may want to protect what they bring into the relationship.

The thought of losing control over business interests, investments or property can lead to feelings of insecurity that often trigger arguments.

Defining your property rights in a prenuptial type agreement can dispel these doubts and actually lead to a more harmonious relationship.

If you are entering into a second or subsequent marriage with children from a previous relationship, it’s quite common to have concerns for the preservation of family property.

As part of a sound estate plan, a financial agreement can provide the peace of mind that accumulated wealth will be quarantined and passed on to your children in the event of separation or death.

In a similar fashion, a prenup can also quarantine debts so that the other party is not held responsible for debts down the track.

Putting a plan in place now while you are most in love and most in tune with each other is the optimum time to discuss how to proceed if the unthinkable happens. It’s just like an insurance policy, you hope you never need it but it’s best to be prepared.

Back in 2000, when financial agreements were introduced, the lawmakers were responding to a need to lessen the load on the Family Court System.

They recognised that couples often know what they want to achieve with a binding contract, but there must be a legal safety net to ensure equality in the bargaining power of the partners.

This safety net is the mandatory legal advice.

Essentially both partners are required to have a conversation with a lawyer about their agreement to make sure that they each understand:

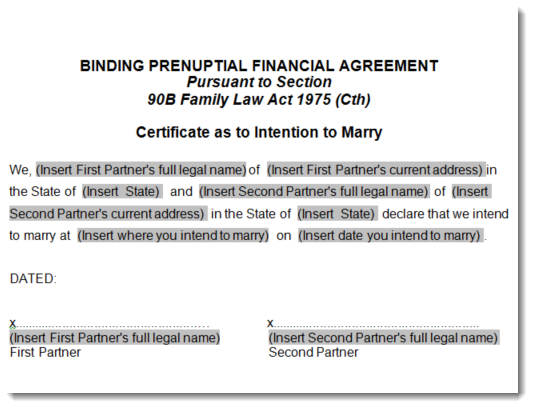

After the consultation, their lawyer is required to issue them with a Certificate of Legal Advice. The parties can sign the agreement and move on with their lives confident that their financial resources are protected.

The Legal Advice acts as a Safety Net and ensures the strength of your agreement

We’ve designed the Peaceful Path process to be straightforward.

We show you what to do and how to do it at each step of the way.

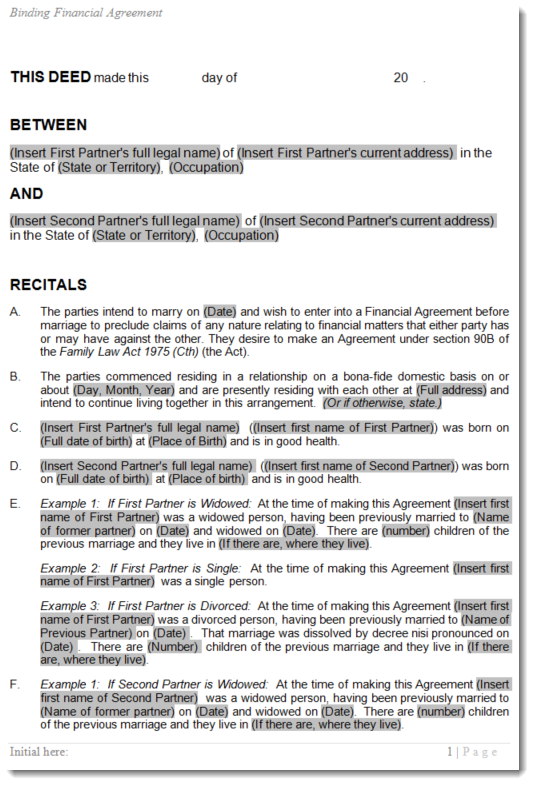

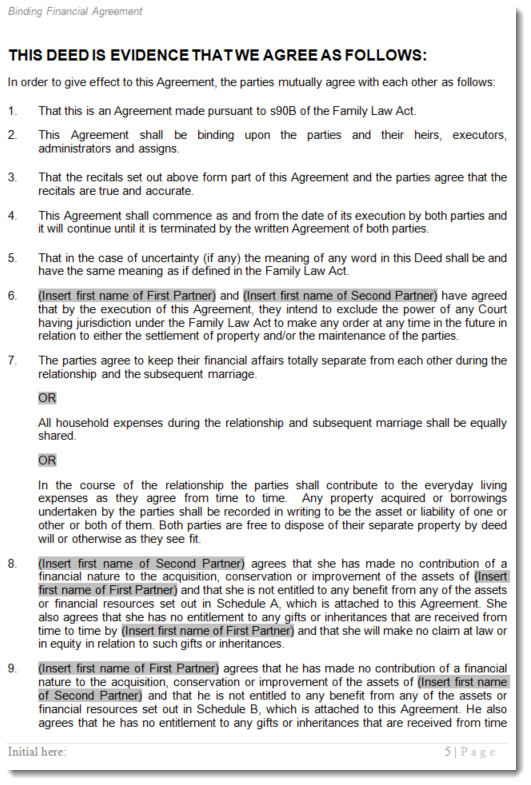

The prenup Agreement template is the blueprint that provides the basic structure for how the settlement is going to look.

The prenup Agreement template is the blueprint that provides the basic structure for how the settlement is going to look.

In the second step, you and your partner add the material facts to the agreement, the building blocks, the things you know about your personal situation – what you own, what you owe and how it will be divided.

In the second step, you and your partner add the material facts to the agreement, the building blocks, the things you know about your personal situation – what you own, what you owe and how it will be divided.

We’ll help you caress those basic building blocks into a robust agreement that the lawyers will quickly understand and be able to advise you efficiently.

We’ll help you caress those basic building blocks into a robust agreement that the lawyers will quickly understand and be able to advise you efficiently.

This is a unique part of the process that opens the door to the Fixed Price Legal Advice. You won’t find this anywhere else.

Without this assessment the lawyers wouldn’t be confident of receiving high quality documents and could not possibly stick to a fixed fee service.

Because we control the quality of the agreements the lawyers receive, they know how much work should be involved and that all adds up to substantial savings for you.

In the fourth step, you’ll purchase the Legal Advice for just $

In the fourth step, you’ll purchase the Legal Advice for just $

for both partners (in most cases), speak with your lawyer (all done via phone and email) and finalise your agreement.

And lastly, you’ll sign your Agreement and store it safely away

And lastly, you’ll sign your Agreement and store it safely away

We work with you from start to finish; from the moment you download your agreement to the final signature.

Buy Prenuptial Financial Agreement 90B Template Kit NowWe know our stuff, our systems are finely tuned and our customers love us for it!

Want to read more customer stories? Click here

RP Emery have been providing legal kits for nearly 30 years and specialising in Financial Agreements since 2009.

We have literally helped thousands of couples put their prenup in place, at a fraction of the normal cost.

We produce our kits for people who aren’t familiar with family law and financial agreements. The kit includes all the resources you need to complete the template without tearing your hair out.

Our role in the Peaceful Path doesn’t stop once you download the agreement. We are your safety net and guiding hand, and our aim is to make this process as easy as possible for you.

Buy Prenuptial Financial Agreement 90B Template Kit Now