You know that financial agreements are a great tool for determining how separated or divorced couples will divide their joint property. But did you know that they can be used by couples in an ongoing relationship?

Or before you move in together or marry?

Whether you are in a de facto relationship, getting married again or have married again, you can use a Financial Agreement just as you did during your separation, but in this case, you are making decisions now about how to protect your wealth, just in case things don’t go to plan.

It’s a bit like insurance – we don’t like to think about crashing our cars or our house burning down, but we do, and we insure against that loss.

When your relationship is young and you are both looking forward to a shared life together, it’s the ideal time to talk about putting a financial agreement in place. It gives you the opportunity to openly talk about the difficult issues when you are amicable and non-combative. In this way you are preparing the ground for an open and honest relationship.

This is exactly what Maureen discovered.

“Both my partner and I had the opportunity to talk through many issues as a consequence of just reading through the draft BFA. Having been through the process to a successful completion, we both feel well able to move forward with confidence about the future. We have also learnt a great deal about each other and have established a trust in each others’ willingness and ability to talk through difficult topics and to do what is needed to make sure the ’t’s and I’s’ are dealt with well. We can now be generous with each other, make plans for joint ventures, and feel fully creative in our plans for the future.”

It doesn’t really matter if you are a defacto or married couple because the process of creating an agreement is the same. But there is often some confusion about the rights and entitlements for defacto couples so we will address some of those here.

De facto couples in Australia do share the same rights as married couples under the law.

However, there is no automatic right to a share in property held by the other party. Rather, the Family Law Act gives each party the right to apply to the Court, in order for the court to assess the matter and decide whether to divide property or other assets.

The Court will make a decision and hand down Orders, which may entail a division of property between the parties, spousal maintenance, or orders with relation to parenting issues such as custody.

An application to the Court can only be made by a de facto partner, if relationship lasted for a minimum of 2 years and this does not have to be a continuous 2 year period. There are exceptions to this rule which you can read about here.

A financial agreement locks the door to the court for the matters that are dealt with in the agreement. By working out what you will do ahead of time you can avoid any uncertainty and make any potential separation far less stressful.

The financial agreement can address:

This might be particularly pertinent, for example, for a party entering a second relationship, who wants to ensure that assets previously accumulated are passed down to his or her children, rather than become a part of the property pool of the new de facto relationship. Or to ensure that a child’s inheritance is not compromised by the debt of a new partner.

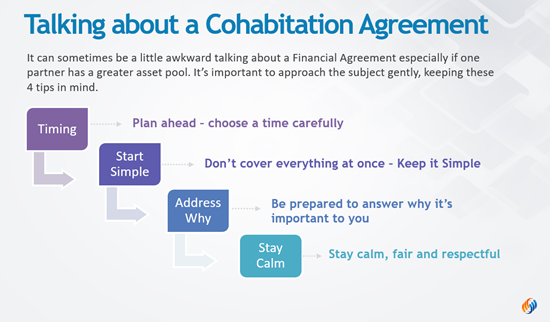

We’ve written an article on talking to your partner about a financial agreement which you can view here. We outline 4 important steps as set out below.

The process for putting a financial agreement in place for a defacto or married relationship is exactly the same as for separation except the document you use will be different.

Follow these steps:

That’s what Chris did – read Chris’ story

“So, I become a return customer to RP Emery, but this time for a Binding Financial Agreement before my fiancé and I marry. In this instance we are very much in agreement as to what we want… and with no one to interfere, neither of us want to pay a lawyer to draw up a draft agreement from scratch when with minor changes the RP Emery document serves our needs exactly..!”

Choose from either the Prenuptial or Post Nuptial Agreement.

Before Moving in together – All states except Western Australia

Before Moving in together – Western Australia

After Moving in together – All states except Western Australia

After Moving in together – Western Australia

We also offer Same Sex Financial Agreements

Please give us a call on 0266725904 – we’d love to help.